Real estate projects are one of the most popular and profitable types of investments, in Dubai. If you are an end-user, would like to settle in Dubai – there are plenty of real estate projects in the market for you to consider. Depending on the location and preferences you can have a studio in Silicon Oasis or a luxurious villa in Dubai South.

On the other hand, real estate investors who are looking for high ROI are even in a better situation. Due to the development of the city and upcoming Expo 2020, Dubai has vast variety of off-plan projects. Depending on the location of the real estate project, ROI can differ from 6% to 10%. So what real estate project should investors invest in?

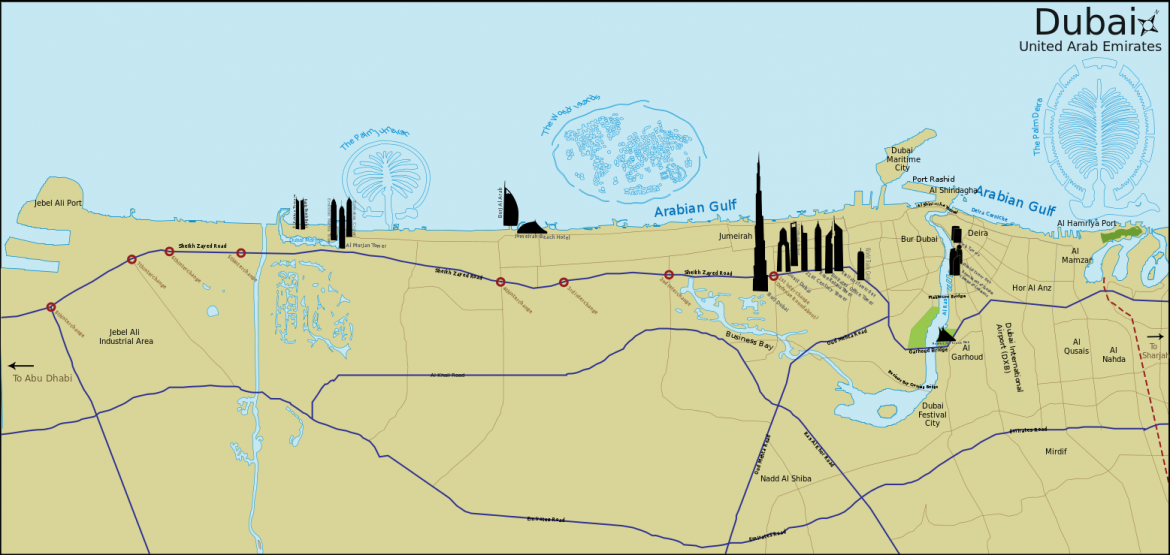

Importance of the location of the real estate project

When it comes to real estate projects and real estate investments, return on investments is the main thing. It determines what project investors will invest in. Dubai has certain locations which can promise high ROI for real estate investors. If you are aiming for 7%-10% ROI take into consideration the following locations: JVC, JLT, MBR City, International City, Dubai Silicon Oasis or Dubai Sports City. The main reason for these locations to offer high ROI is that they are still developing. Investors used to prefer downtown and The Palm, few years back. Nevertheless, in the last years, the market trend has changed. Dubai real estate investors started considering smaller units. Studios and 1BR apartments bring higher ROI, compared to big apartments and villas.

Real estate project developer

Quality and overall ROI can depend on the real estate project developer, as well. Well-recognized developer with good reputation tends to attract more investors. Trust builds brand and brand sells better. As an outcome, by investing in a real estate project of a well-known developer you are securing yourself in a few ways. Overall ROI of the real estate project is high, and the finishing of the project is outstanding.

What real estate projects should you consider as a good investment?

When it comes to real estate projects and ROI, there are few developers which any real estate investor should consider. Emaar Properties (semi-governmental developer) is one of the biggest real estate developers in UAE. By investing in one of their projects, such as Expo Golf Villas, Creek Edge or Sirdhana, you will be assured to receive an apartment with outstanding finishing and with high ROI.

Ellington Properties is a new developer in a Dubai market which managed to attract many investors in a very short period of time. One of the main unique selling points is design on units. Ellington uses the help of professional, well-known designers while working on each project. Every single detail is taken into consideration, from the greenery and landscape to the unit design and furniture color. If you are looking for a stylish apartment with the exceptional design – Belgravia, Wilton Terrace or Eaton Place are one of the top projects you should consider.

If you are looking for exceptional, unique projects like 1JBR – one of the residential buildings with its own private beach – you should consider Dubai Properties. This is a semi-governmental developer with a list of top real estate projects. Looking for quality, uniqueness, and reliability – invest in Dubai Property projects.

Dubai is a representation of what can be called the Perfect Environment for Investments. Whether you are end-user or investor – investment in Dubai real estate is always the right and profitable decision.

Contact property advisors of Universal Prime Real Estate and let’s invest together.